A step-by-step course on nonprofit accounting and using QuickBooks for your nonprofit organization.

(No accounting skills needed!)

You’re a nonprofit leader with a big vision for your organization. You’ve thrown yourself into your work and you can see how you are making a difference.

But now you are running into one *little* problem -- QuickBooks.

Who knew nonprofit bookkeeping would be so hard?

You know that to get the big grants and grow your organization, you must learn how to manage and use QuickBooks!

You’ve tried everything you can think of to solve your organization’s QuickBooks problems.

- You’ve spent gobs of time on the Internet researching nonprofit accounting only to find articles that are mind numbing to read and don’t address your situation.

- You tried to fix your reports by adding accounts to the chart of accounts. As a result, your chart of accounts and reports have grown ridiculously long.

- You’ve been through a series of volunteer and paid bookkeepers, only to find none of them are able to produce the reports you need, either.

- You tried to outsource the accounting only to find you are paying a lot of money for reports that arrive late and that still don’t give you the information you need.

What if I told you that you could...

- Easily set up your QuickBooks company file using our proven template?

- Do-it-yourself, even if you are not an accountant?

- Cut down on your bookkeeping expenses?

- Successfully use QuickBooks to run your organization?

Yes you can!

How do we know you can master QuickBooks?

Hi, we're Carrie and Carol. We have worked with hundreds of nonprofit organizations to help them successfully implement and use QuickBooks. We’ve also taught QuickBooks – one-on-one to our clients, in the classroom and in online courses.

We’ve experienced what works – and what doesn’t work – when it comes to using QuickBooks in a nonprofit organization.

We developed a QuickBooks template for nonprofits that we call QuickBooks® to Go! This template includes a QuickBooks company file and bookkeeping procedures that walk you through how to enter transactions. Now you can customize the template instead of trying to create a QuickBooks company file and documentation from scratch.

We walk you step-by-step through the things you need to know to successfully use QuickBooks.

Just imagine what it would feel like to...

- Know you can run the QuickBooks reports you need any time

- Have confidence that your books are accurate

- Be ready for your audit and annual Form 990

- Use QuickBooks to grow your organization instead of worrying about it all the time

Other QuickBooks programs provide information. We deliver information tailored to using QuickBooks in a nonprofit environment. Even better, we show you exactly how to implement QuickBooks in your organization with done-for-you templates.

I so appreciate all the help and guidance you have provided! You have really helped us develop a great understanding of our accounting process. I am able to sleep at night knowing that we have financials that help us see where we are and that was not even close to being possible before.

~ Michelle Soto, BETA Center

Here's what you will learn:

✅ Week 1 – Nonprofit Activities (Functional Areas)

Get clarity around what your organization does and how that aligns with what the IRS allows as tax exempt activities. Discover taxable activities of nonprofits. Learn about accounting for programs and support activities central to nonprofit accounting.

✅ Week 2 – Accounting Framework

Start building your QuickBooks company file using QuickBooks® To Go!. Learn where accounting rules come from and the different levels of CPA services. Understand reasons for outsourcing vs. handling bookkeeping in-house.

✅ Week 3 – Nonprofit Income

Learn how to record many types of income received by nonprofits including donations, in-kind gifts and program service fees. Deep dive into special events, where you typically encounter several kinds of income that must be tracked separately. Watch a demonstration of how to enter income into QuickBooks. Distinguish when to use a sales receipt vs. an invoice.

✅ Week 4 – Nonprofit Expenses

Learn how to record nonprofit expenses. Understand the difference between employees vs. independent contractors. Find out when to use a bill vs. an expense. Learn about charitable assistance, an expense unique to nonprofits. Gain an understanding of depreciation. Watch demonstrations of how to enter expenses into QuickBooks.

✅ Week 5 – Balance Sheet

Learn about the main types of accounts found on the balance sheet. The balance sheet is critical to understanding your organization's financial strength and keeping your monthly bookkeeping on track. Understand the annual accounting cycle that every organization must manage.

✅ Week 6 – Financial Reports

Watch a demonstration of how to run financial reports in QuickBooks using our QuickBooks® To Go! framework. Create beautiful reports for your board and for management use.

✅ Week 7 – Nonprofit Financial Management

Set up a recurring monthly system to keep your new QuickBooks system on track. Learn how to use bank feeds. Bank feeds help you record transactions and do reconciliations more easily.

✅ Week 8 – Restricted Grants

Learn how to setup and record basic restricted grants. Discover how to use QuickBooks to keep track of restricted gifts and grants instead of using Excel.

Beyond this course, more detailed information on tracking restricted gifts and grants can be found in the bonus self-study course that comes with Nonprofit Accounting & QuickBooks® called Accounting for Restricted Gifts & Grants in QuickBooks Online.

No matter your level of experience or size of your organization, Nonprofit Accounting & QuickBooks® will help you fill in the missing puzzle pieces so you can successfully use QuickBooks for your organization.

The course will provide you with...

- The foundation knowledge you need to make sense of nonprofit accounting

- A QuickBooks company file that reflects your organization

- The skills to read basic financial reports

- The ability to account for basic grants using QuickBooks (instead of Excel)

- The knowledge to use QuickBooks effectively to record your organization’s financial transactions

- A process for maintaining your new QuickBooks bookkeeping system

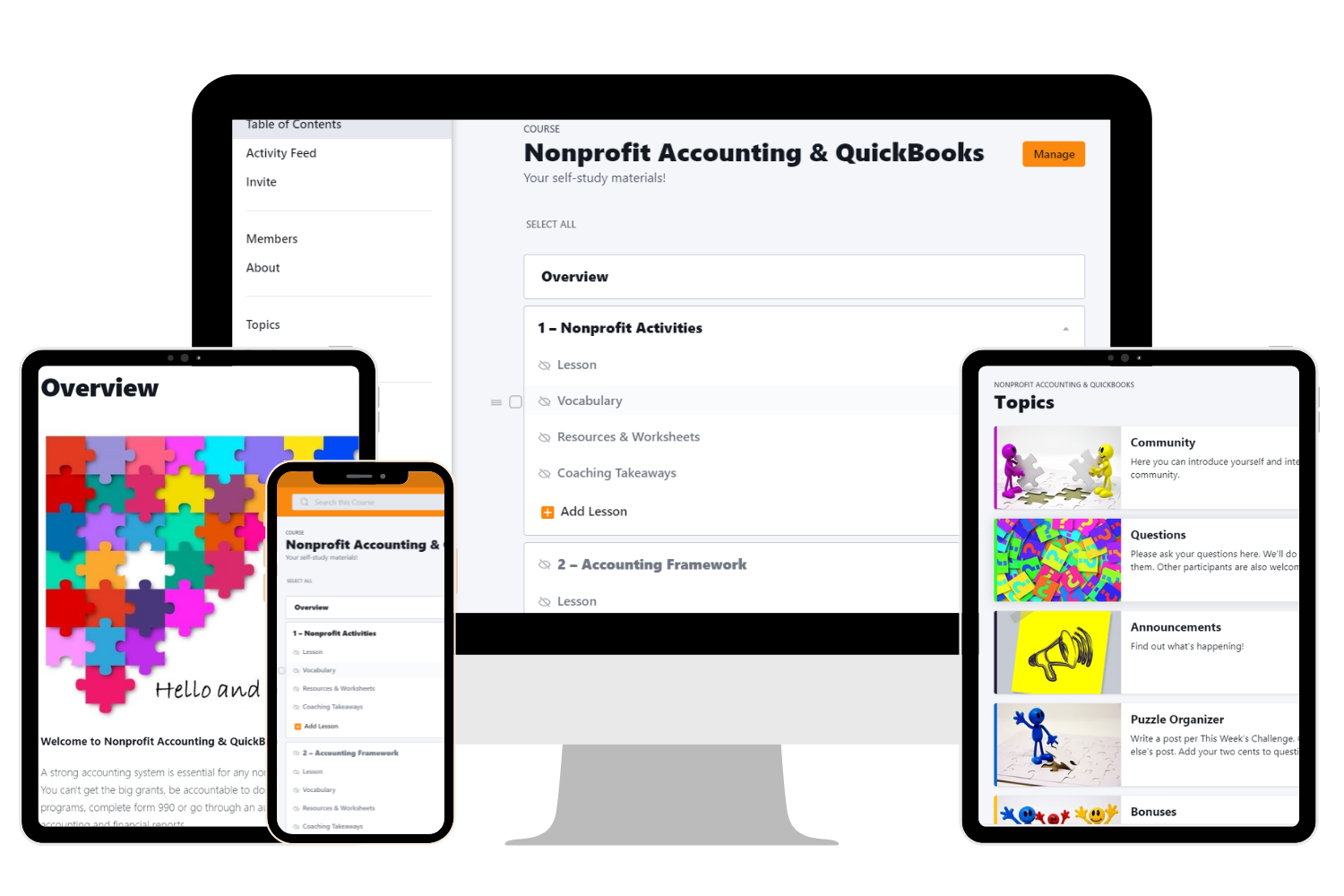

Here's what you get when you join:

- Immediate access to the Nonprofit Accounting & QuickBooks® course

- 8 modules packed with our combined experience and knowledge, including

- Over 7 hours of recorded lectures and demonstrations of both QuickBooks Online and QuickBooks Desktop (VALUE > $1,000 at our normal hourly rate of $150/hr)

- Over 7 hours of coaching sessions where we address student questions (VALUE > $1,000 at our normal hourly rate of $150/hr)

- Written documentation

- The QuickBooks® To Go! done-for-you template to help you set up your organization’s QuickBooks (STAND ALONE PRICE $449)

- Other done-for-you templates to help with tasks such as functional allocations

- Plus bonuses!

Bonuses ✨

We have three bonuses for you!

Bonus #1: Access to the community and free resources within Smart Nonprofit Money (VALUE $150)

Smart Nonprofit Money (SNM) is the private network where we host this course. Right now the only way to gain access to SNM is through this course. Within the SNM network, you can build relationships with other nonprofit leaders and find people who are working problems similar to your own. Plus we share free articles and templates that we think you'll find useful!

Bonus #2: Nonprofit Accounting Policies & Procedures template (VALUE $50)

Finally put your organization’s accounting policies and procedures into place using our template for small to mid-size nonprofit organizations. Have you ever tried to read any of the “free” templates? Ours has fewer words and more impact.

Bonus #3: Access to our self-study course, Accounting for Restricted Gifts & Grants in QuickBooks Online ® (VALUE $150)

We go into more depth on accounting for different kinds of restricted grants. Much of the content also pertains to QuickBooks Desktop, so Desktop users will also find it valuable.

Investment

Registration for Nonprofit Accounting & QuickBooks® is $449. Compare this price to the value you receive.

- 15+ hours of time with Carol or Carrie, included in the course recorded videos, would cost $2,250.

- The QuickBooks® To Go! tool included with the course sells separately for $449.

- The value of the bonuses described above totals $350.

All together you have over $3,000 in value for only $449!

Don’t delay. Make this year the year you solve your nonprofit accounting puzzle and set the stage for growth and success.

Here's what happens when you sign up:

1. You will receive an enthusiastic email from us welcoming you to the course!

2. You get immediate access to the course and the Smart Nonprofit money community.

3. You will have ongoing access to the course. (We guarantee one year from date of purchase, though likely much longer.)

Yes I Want To Understand Nonprofit Accounting & QuickBooks!

Nonprofit Accounting & QuickBooks® saved me so much research time and trial and error. As someone who had tried to use QuickBooks before with no guidance, this course organized everything I was looking for in one place.

Carol and Carrie are so knowledgeable about nonprofit accounting and using QuickBooks and it shows. Their expertise and welcoming environment helped me feel comfortable using QuickBooks with my small but growing nonprofit. Carol and Carrie are able to explain their processes easily and their course provides you with a great framework for doing nonprofit accounting on your own.

~ Vikki Gutman, Founder, Chicas Rockeras SELA

FAQs

Q - Is Nonprofit Accounting & QuickBooks® applicable for QuickBooks Desktop and Online software?

A - Yes. The underlying concepts are the same and in most cases the implementation in the software is similar, even though each software has a unique look and feel and the exact menu steps are different.

Q - I’m a total newbie when it comes to accounting. Is this training program for me?

A - You will probably need to work a little harder, but we think there’s no better place to start learning than here. You will have supportive people cheering you on who have been struggling with the same issues. Besides, even folks experienced with accounting often have trouble with the unique complexities of nonprofit accounting.

Q - Will I be qualified to do nonprofit bookkeeping after taking this course?

A - We provide a solid foundation in nonprofit accounting basics and show you ways to make QuickBooks work for unique nonprofit accounting needs. That being said, we cannot possibly go over everything you may need to know as a nonprofit bookkeeper. Also the nature and complexity of accounting from one organization to the next varies considerably. Our aim is to give you fundamental knowledge that provides an excellent base for continued learning.

Q - Is there a guarantee?

A - We never want you to be unhappy with a course! You have 30 days from your purchase date to request a full refund.

Q – Will I have access to the course materials after it is completed?

A – Yes! The course is housed within our private online community Smart Nonprofit Money. You will have access to all course materials including video replays, tools and reading assignments for the life of Smart Nonprofit Money. Though we don’t have plans to go anywhere, we guarantee access for at least one year from the last day of the course.

Recap of What You Get

Register now to get everything in Nonprofit Accounting & QuickBooks® plus valuable bonuses:

- Immediate access to the course and all future updates

- Training designed and lead by CPAs with a proven track record helping nonprofit leaders succeed with QuickBooks

- 8 modules packed with our combined experience and knowledge, including

- Over 7 hours of recorded lecture and demonstrations of both QuickBooks Online and QuickBooks Desktop (VALUE $1,125 at our hourly rate of $150/hr)

- Over 7 hours of coaching sessions where we address student questions (VALUE $1,125 at our hourly rate of $150/hr)

- Written documentation and reading assignments

- Assignments to guide you through creating your QuickBooks accounting system

- QuickBooks® To Go!, a done-for-you template to help you set up your organization's QuickBooks. Includes a QuickBooks company file template designed for nonprofit organizations and bookkeeping documentation. (VALUE $449)

- Additional tools and templates to help you with key areas of nonprofit accounting such as functional allocations

- Bonus #1: Membershp in Smart Nonprofit Money, an online private community of nonprofit leaders plus free resources (VALUE $150)

- Bonus #2: Nonprofit Accounting Policies & Procedures template (VALUE $50)

- Bonus #3: Access to our self-study course, Accounting for Restricted Gifts & Grants in QuickBooks Online® (VALUE $150)

All together you have over $3,000 in value for only $449.

Join Nonprofit Accounting & QuickBooks® now! Solve your nonprofit accounting puzzle in a fun and engaging format!

Carol and Carrie have been absolutely transformational for our non-profit organization. It’s difficult to find strategic resources that can make a positive impact in short period of time, but that’s just what happened. We’ve captured all the moving financial pieces within our organization and now we’re truly able to use the QB platform as a financial tool moving forward.

~ Richie Gray, E.D., Florida Rush Soccer