What are Unrestricted Net Assets?

Alternative title: I love you, I need you, unrestricted net assets!

title: I love you, I need you, unrestricted net assets!

“Look at all this money we have! I don’t understand why we can’t pay the bills,” exclaimed Todd, a member of the board of directors, as he looked at the balance sheet.

“What number are you looking at, Todd?” I asked.

“Right here at the bottom. It shows we have a hundred thousand dollars!” he exclaimed.

“Oh, you are looking at net assets. That is not the same as cash.” I replied.

The above conversation is fictitious, but it follows some of the conversations we’ve had with folks over the years. A common misperception is that net assets equals the amount of resources the organization has immediately available to spend.

Unfortunately this idea is not true.

Let’s take an example using a make-believe organization. We’ll call it Happy Families Center (HFC).

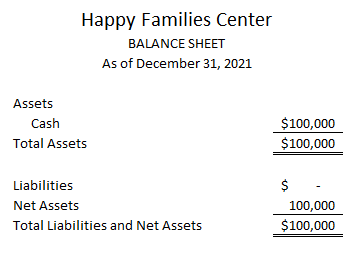

HFC has cash in the bank of $100,000. Cash is HFC’s only asset.

HFC has no debt whatsoever. Nothing owed to vendors. Not even amounts owed to employees for wages earned.

In this simple example, HFC has a balance sheet that looks like this:

In the above example, net assets of $100,000 does in fact equal total assets (cash) of $100,000.

However, the above example is not realistic. It’s not impossible, but certainly would be rare.

Even if this situation were to occur, you’d have to find out if all that cash is unrestricted. What if the entire $100,000 came from a restricted grant?

Example with Restricted Cash

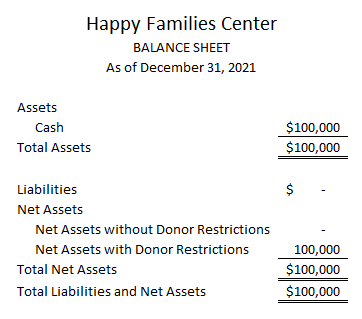

Say we had the organization above and all the cash came from a $100,000 grant restricted for building a new family services building. Here is what the balance sheet would look now:

In this case unrestricted net assets (net assets without donor restrictions) is zero!

Note the official wording for unrestricted net assets in the balance sheet above is “net assets without donor restrictions.” We commonly use the term “unrestricted net assets” since it’s easier to say. Also that’s the way we’ve always said it until a recent accounting pronouncement introduced the new language.

Similarly, “net assets with donor restrictions” is the official terminology for restricted net assets. Restricted net assets have restrictions imposed by the donors.

Having only restricted cash as in this example would put a damper on using that money for any other purpose. Not even purchasing a few basic office supplies!

What if the $100,000 grant was restricted not for a building, but for use in running a counseling service? You’d have to check the details of the grant to see exactly what types of expenses are included. Likely there’s a budget that shows how much can be spent on payroll, technology, office expenses, etc. In that case, you would be in luck if you wanted to use the money for the counseling program.

But what about expenses that are not part of the counseling program? Expenses like the executive director’s time? Fees for bookkeeping help? Fund development? A different program?

These other expenses cannot be paid for with a grant restricted to the counseling program. Cash is not as simple as it seems when it comes to nonprofits!

Example with Assets Other Than Cash

Let’s change our make-believe nonprofit to be a little more realistic. Let’s say that HFC has some assets other than cash.

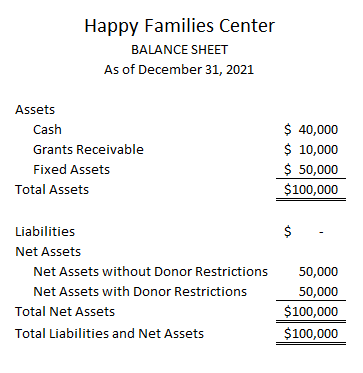

Their balance sheet looks like this:

The above balance sheet still shows $100,000 in total net assets. But now cash is only $40,000. The other assets making up net assets are grants receivable of $10,000 and fixed assets of $50,000.

In this example, net assets of $100,000 obviously does not represent cash you can spend. You can’t spend non-cash assets like receivables and fixed assets. At least not immediately.

Fixed assets means things like buildings, vehicles and equipment. Perhaps you could sell the fixed assets to raise cash, but that may take time. Also it may not be desirable to sell the property and equipment your organization uses in its operations. Even if you did sell, you’ll likely get sale proceeds different than the $50,000 carrying value.

Grants receivable means grant funding that has been committed to the organization but not received. Grants receivable will be cash in the future, but it is not cash now.

Notice that the split between net assets with and without donor restrictions has changed.

Net assets with donor restrictions is due to the $40,000 in cash, all of which is from a restricted grant, and the $10,000 grant receivable.

Net assets without donor restrictions (unrestricted net assets) is the balance left in net assets after subtracting restricted net assets. In this simple example, you can see that it’s made up of the $50,000 in fixed assets.

It’s possible for fixed assets to have donor restrictions, for example a building that can only be used for a specific purpose, but in this example fixed assets are not restricted. Even if fixed assets are unrestricted, though, they are still not cash nor are they usually easily converted to cash (liquid).

Net assets represent assets minus any liabilities of the organization.

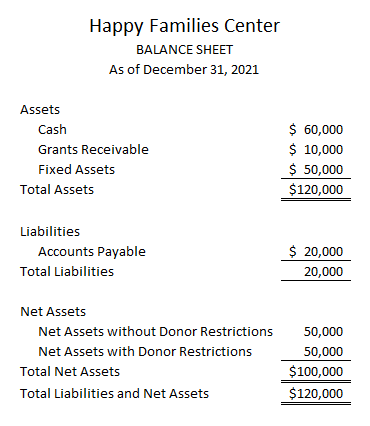

Up to now, we have not complicated the balance sheet with liabilities. However, at any given point in time, it’s likely that an organization owes money to various parties for various reasons. To make our example a bit more realistic, let’s consider the following balance sheet:

Now cash is $60,000 and liabilities, specifically accounts payable, is $20,000. Accounts payable means the organization owes money to vendors in the near future.

Notice net assets remains unchanged at $100,000. Why is that? Because net assets equals total assets minus total liabilities. Net assets is the amount of assets not financed by debt.

That’s why the balance sheet always stays in balance! Total assets always equals the sum of total liabilities plus net assets.

It turns out that Todd, our board member who wants to understand the organization’s liquidity, needs to understand the entire balance sheet.

Also understanding an organization’s financial strength is more involved than simply looking at net assets. Or simply looking at cash, for that matter. You may enjoy this article that offers additional insights on nonprofit liquidity or this post we wrote previously, ASU 2016-14: Cash and Nonprofit Liquidty.

Understanding what net assets is vs. what it is not is a helpful start to understanding an organization’s ability to survive and thrive.

What about net assets in your organization?

Now that you know the concept, look at your organization’s balance sheet again with fresh eyes. Keep in mind that, unfortunately, net assets is often not broken out properly in internally generated balance sheets. Even if it is, you may still need to ask questions to understand the nature of any restricted assets.

If you have an audit, you can look at the most recent audited balance sheet. The notes at the back of the financial statements will include detailed information on the nature and amounts of restricted net assets. The audited financial statements would be a good starting point.

Now compare the audited balance sheet to the balance sheet in the latest financial reports for the board. Does this balance sheet break out net assets in a similar manner? Or is the detail of restricted net assets omitted or possibly incorrect?

Understanding net assets is critical to assessing an organization’s financial strength. We love all kinds of net assets, though we have a special place in our hearts for unrestricted net assets.

3 Comments

Leave a Comment

You must be logged in to post a comment.

Is there currently a systematic way to account for Net Assets with Donor Restriction related entries (income/expense and tracking directly to the Net Assets with Donor Restrictions Equity Account) in QBO online, that does not require you to use Classes and Ledger Entries? I still want to use the functional expense accounts we use as well.

Would be nice if QB would catch up and let us create sub-accounts to split out the different types of net Assets. I currently use Journal Entries to shift $$ out of Net Assets/Net Income and into a custom defined Equity lines for Donor Restrictions. It’s never simple.

Thanks. I will add it to my list of requests to INTU to consider. Maybe one day a group of NPs and accountants can make a big push for updating some of the functionality for us, even their customized reporting does not come close.