UPDATE – The minimum salary threshold under the Fair Labor Standards Act that was supposed to increase effective July 1, 2024 has been shot down. The U.S. District Court for the Eastern District of Texas overturned the latest minimum salary requirements set by the Federal Department of Labor (FDOL). We now must look back to…

Read MoreThe employees of your nonprofit organization have worked hard all year for way less than they’re worth. Wouldn’t it be nice to give each one a holiday bonus as a thank you? Cash Bonuses Each holiday season we see nonprofit organizations pay cash bonuses to employees outside the normal payroll process. We need to address…

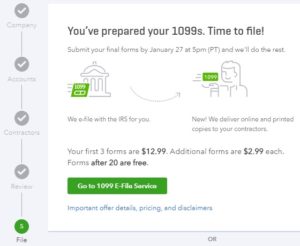

Read MoreLet us guess. What you really want is not just basic 1099-MISC instructions. You want the inside scoop on how to deal with this task so you can cross it off your list. You want peace of mind that you are complying with IRS requirements. And if you’ve ever been through a “hair on fire” January…

Read MoreOne of the biggest, if not THE biggest expense for many nonprofit organizations is payroll. We often see problems in the way payroll expenses are entered into the books of nonprofit organizations. Here are a few common mistakes: Gross wages, payroll taxes and payroll service fees are mixed up in the same account. Payroll tax…

Read MoreA reader asked for advice on hiring her organization’s first employee. First let us say congratulations for reaching this milestone! Your first employee, while exciting, also opens up a whole new world of responsibilities, risk management and administration. What are the critical steps? Where do you begin? We offer a punch list of things you…

Read MoreBefore we embark on the Grand Tour of the Chart of Accounts, a timely topic came to our attention. This month, of course, is January, the month when you must get those 1099-MISC forms out to all your non-employee contractors. It’s easy to forget, until you have to deal with it each year, just what…

Read MoreRecently we’ve seen the following scenario happen in two nonprofit organizations: First, the organization accidentally overpays an employee. In one organization, it was confusion over how to use the payroll software which caused a paycheck to be submitted twice for processing. In another organization, a bonus paycheck was direct deposited to the wrong employee. Both…

Read MoreThe start of a new year is fast approaching, bringing with it an opportunity to do things differently than you did them in 2017! If your payroll system has been one of those problems you’d like to leave behind, the new year is a prime time to start anew. While your fiscal year for accounting…

Read MoreWhether you do payroll in-house or use an outsourced payroll service, you may be experiencing unnecessary costs. And these costs pile up payroll after payroll, month after month. Here are a few of the worst offenders. #1 – Processing Fees Let’s start with the obvious. Chances are your payroll service is charging you per payroll.…

Read MoreIf you are like most nonprofits, paying people for services is your largest expense. It’s not unusual for payroll and contractor payments to make up 80% or more of total expenses. It’s also an area with many tax compliance issues and bookkeeping challenges. Consider what combination of accounting software and payroll software and/or services would…

Read More