This week we pick up our Nonprofit Chart of Accounts Grand Tour talking about cash. Cash is the lifeblood of a nonprofit organization. It’s also the first account on the balance sheet since it’s the most liquid asset. Nonprofit cash has attributes that are very different from the cash of for-profit companies. In this post…

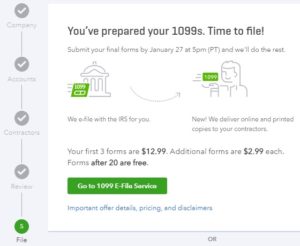

Read MoreBefore we embark on the Grand Tour of the Chart of Accounts, a timely topic came to our attention. This month, of course, is January, the month when you must get those 1099-MISC forms out to all your non-employee contractors. It’s easy to forget, until you have to deal with it each year, just what…

Read MoreNonprofit bookkeeping is simply coding transactions to the chart of accounts. What could possibly go wrong? Based on the questions we receive and the nonprofit clients we help, apparently a lot! Accounts Are Mandatory Every transaction recorded in your nonprofit’s QuickBooks (or other accounting software) must be coded to two or more accounts in your…

Read MoreIt’s a new year and a chance to give your nonprofit accounting a fresh start. Right? Not so fast. If your year for accounting purposes is the calendar year (as opposed to a fiscal year ending in a month other than December), your profit and loss report starts out in 2018 with fresh, clean accounts…

Read MoreDo you accept credit cards donations or credit card payments for goods and services? If so you need to be able to record them in QuickBooks. Credit cards payments are normally not received by your bank until a few days after you’ve run the charge on the customer’s card. That means the credit card sales…

Read MoreDecember is a busy month for most nonprofits. Various sources place the percentage of annual gifts made in December at more or less 30%. But which gifts count for December? Regardless of your organization’s fiscal year, all organizations must deal with the year end gift cutoff of December 31 for tax purposes. The IRS requires…

Read MoreRecently we’ve seen the following scenario happen in two nonprofit organizations: First, the organization accidentally overpays an employee. In one organization, it was confusion over how to use the payroll software which caused a paycheck to be submitted twice for processing. In another organization, a bonus paycheck was direct deposited to the wrong employee. Both…

Read MoreThe start of a new year is fast approaching, bringing with it an opportunity to do things differently than you did them in 2017! If your payroll system has been one of those problems you’d like to leave behind, the new year is a prime time to start anew. While your fiscal year for accounting…

Read MoreDo you sometimes discover transactions entered into your nonprofit organization’s QuickBooks more than once? Twins are cute, but not in your books! Duplicate transactions cause your financial reports to be inaccurate and can be time consuming to fix. Clues that you have duplicate transactions can be found in your monthly bank reconciliation. Look closely at…

Read MoreWe’ve heard many times from nonprofit executive directors: “My board only understands cash.” Even executive directors themselves often admit to being more comfortable with cash basis than with accrual basis financial statements. And we can’t blame you – all you cash basis fans out there are rightly concerned about, well, cash! Introducing ASU 2016-14 And…

Read More