Nonprofit Revenue Recognition Part 2 of 2

Welcome to the second installment of our two-part series on nonprofit revenue recognition.

Welcome to the second installment of our two-part series on nonprofit revenue recognition.

In the first post of this two-part series we:

- Covered the history and background for the new revenue recognition standards;

- Explained how to distinguish between contributions and exchange transactions (important for today’s blog post); and

- Gave an overview of conditional contributions and restricted contributions.

Today we cover the next steps if you determine you are dealing with an exchange (as opposed to a contribution) transaction.

We encourage you to read Nonprofit Revenue Recognition Part 1 of 2 before reading today’s post so you know how to distinguish an exchange transaction from a contribution. See the section of the post titled Contribution vs. Exchange.

Types of Exchange Revenue

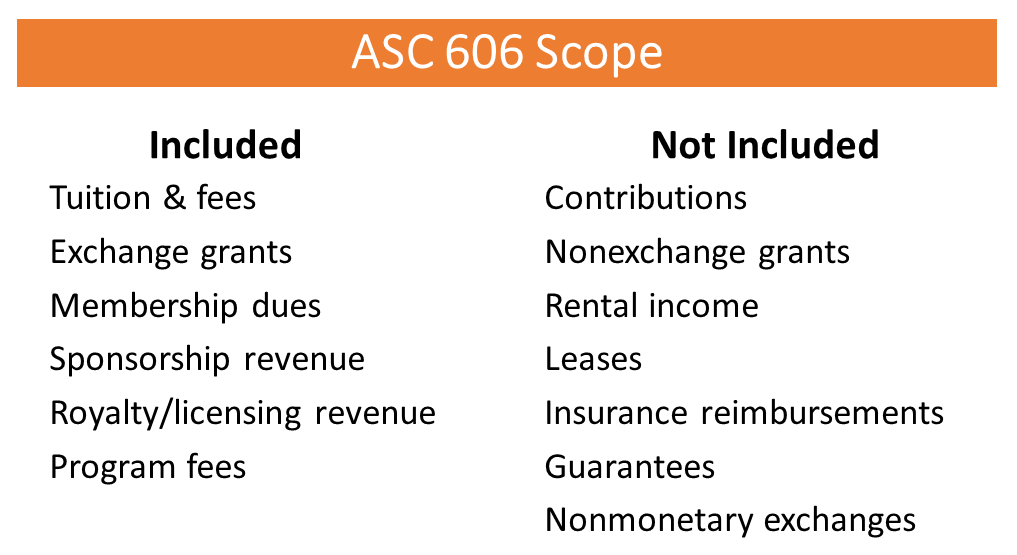

The rules on revenue recognition from exchange transactions are laid out in ASU 2014-09, Revenue from Contracts with Customers. These rules are included in FASB’s Accounting Standards Codification (ASC) Topic 606. So if you hear an auditor say that something falls under “606,” this is what they are talking about.

Here’s a list of common sources of exchange revenue included under ASC Topic 606. Source: Revenue Recognition: A Comprehensive Review for Not-for-Profit Organizations by BKD CPAs and Advisors.

Contracts and awards from governmental agencies can be challenging to identify correctly as contribution vs. exchange. Also memberships can be tricky. We gave more details on both in Nonprofit Revenue Recognition Part 1 of 2 if you want to refresh your memory.

Steps for Exchange Transactions

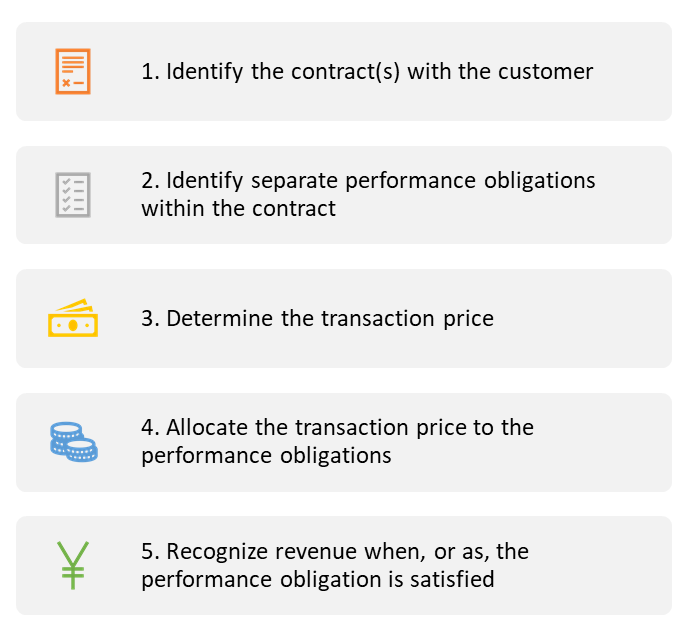

If you determine the award or payment that is given, promised or owed to your organization is NOT a contribution, rather it is an exchange transaction, then the revenue recognition process laid out in ASC Topic 606-Revenue from Contracts with Customers applies.

Here are the accounting steps.

We will walk through each of these steps.

Step 1 – Identify the contract(s) with the customer.

For accounting (not legal) purposes, a contract has the following elements regarding goods or services to be transferred:

- Approval and commitment of the parties

- Rights of the parties

- Payment terms

- Commercial substance

- Collectability of payment must be likely

A contract is not required to be written, although we certainly think a contract in writing and signed by both parties is highly advisable.

Step 2 – Identify separate performance obligations in the contract.

Contracts may have multiple performance obligations, meaning the requirement to deliver goods or services to a customer. The reason for identifying separate performance obligations is so you can recognize revenue as each one is fulfilled.

Two criteria identify a performance obligation:

- Capable of being distinct – The customer can benefit from the good or service on its own or together with other readily available resources.

- Distinct within the contract – The good or service can be identified separately from other promises in the contract.

This aspect of the new rules has implications for how you draft contracts. You should be careful to identify each separate performance obligation and the associated revenue. This step alone can save you in an audit. If separate performance obligations are unclear, you may have a hard time convincing the auditors to let you recognize income for work completed under a contract. You might have to wait until the entire contract is finished, which could fall in a future year.

Even if you already received payment under a contract, you could be required to defer recognition of that revenue. A recent client going through their first audit was required to defer a significant amount of revenue on a consulting contract where it was determined a phase was not completed even though they had been paid by their customer. The result caused unrestricted net assets to be negative on the balance sheet. Note to self for next time!

Step 3 – Determine the transaction price.

Transaction price sounds straight forward, and fortunately most of the time it should be.

If the contract includes discounts or other price concessions, revenue recognized must be reduced based on net revenue expected over the life of the contract. Here’s where it can get tricky. For example, you might have to estimate contract revenue if it’s based on a variable quantity of goods or services to be delivered.

Step 4 – Allocate the transaction price to the performance obligations

In this step you link a price to each separately identifiable performance obligation, such as phases in a contract for services.

If prices are not reasonably assigned to the separate performance obligations in the contract, then you have to figure out how to allocate the overall contract price to each performance obligation. Ways to do this include

- Determine the standalone selling price of each performance obligation (goods or services provided) in the organization’s market

- Mark up the expected cost of providing the goods or services by a percentage

- Use a residual approach, where pricing for a particular performance obligation is based on what’s left after pricing other products and services in the contract.

Make it easy on yourself and your auditor – clearly assign prices to separate performance obligations in the written contract with your customer.

Step 5 – Recognize Revenue

The organization recognizes revenue upon completion of the performance obligation. Sounds simple enough. But when does completion happen? At a point in time or over a period of time?

Revenue Recognized at a Point in Time

Consider a clinic that provides dental services. Completion happens and revenue is earned and recognized at the point in time when a cleaning is performed or a cavity is filled.

An organization that sells books recognizes revenue at the point in time when the book is delivered to the buyer.

Revenue Recognized Over a Period of Time

Now think of a school where education is provided over the course of an academic term. In this example, completion of the performance obligation (education) happens over a period of time. Therefore tuition revenue is recognized pro rata over the academic term.

Here is a good explanation from CliftonLarsonAllen on revenue recognition for schools.

Other Considerations

Contract Assets and Liabilities

Remember in our last post we said just because you receive cash or create an invoice doesn’t mean you have revenue. You have revenue if the criteria for recording revenue has been satisfied.

Determining if you have revenue to record is a big deal for year-end cut off for your audited financial statements.

If you have an unconditional right to receive earned revenue, you would record a receivable. If you have earned revenue but it’s conditioned on something besides the passage of time (such as the organization’s future performance), you have a contract asset.

Think of a contract asset as a “pre” receivable. You may have delivered goods or services to a customer which have been identified as separate performance obligations, but the contract requires additional services to be performed before you can send an invoice for payment. Since you can’t invoice quite yet, the solution is to set up a contract asset with an offset to revenue.

If you receive payment in advance of providing goods or services, you have a contract liability. A contract liability is the same thing as deferred revenue or unearned revenue.

For example, tuition received in advance of the school term is recorded as a contract liability (deferred revenue). It only becomes revenue as it is earned over the course of the term.

Revenue from Licensing Agreements

Interestingly licensing agreements for functional intellectual property such as software and music or theater productions are changed by the new rules. Under the old rules, income from a functional licensing agreement was recognized over the term of the contract, which could span multiple years. Under the new standards, revenue is recognized upon sale of the license which transfers control to the buyer for the period of the agreement. This change has accelerated revenue recognition for organizations that sell functional licensing agreements for intellectual property.

Revenue from symbolic intellectual property, such as use of a logo or trade name, is still recognized over the time period of the agreement.

Major Change to Recording Accounts Receivable

The 5th element of Step 1 – Identify the Contract with the Customer, requires that collectability of the contract price must be likely. This criterion presents a major change to the way we previously accounted for receivables.

Under the prior standards, you recognized the entire payment due under the contract (after being earned) as an account receivable. If you doubt your customer’s ability to pay, you set up an allowance for doubtful accounts with an offset to bad debt. For example, an organization would record accounts receivable and revenue of $10,000, then record an allowance for bad debt of $1,000 and bad debt expense of $1,000 for the amount unlikely to be collected. This method leaves the entire $10,000 in revenue.

Under the new standard, if think you will only collect $9,000 of $10,000 owed at the time you set up the receivable, then you only record a $9,000 receivable and $9,000 in revenue.

This new approach of recording revenue at the net amount expected to be collected especially affects hospitals and other health care providers. If you are interested in learning more, here is an interesting article from BDK CPAs on practical ramifications for the healthcare industry.

To Wrap Up

This post and our prior post give you the highlights of two new accounting standards:

- ASU 2014-09, Revenue from Contracts with Customers, that forms Accounting Standards Codification (ASC) Topic 606 and

- ASU 2018-08, Clarifying the Scope and the Accounting Guidance for Contributions Received and Contributions Made, which resulted in ASC Topic 958-605

Together they provide a comprehensive framework for recording contributions and earned revenue.

An understanding of these standards will allow you to be more proactive in cleaning up your books prior to an audit. They will also help you understand your business better.

For example, our recent client whose organization went through their first audit mentioned several things he now knows how to do better:

- Distinguish gifts from earned revenue;

- Record and monitor advance payments for services since he still has to budget resources to provide those services to the customer; and

- Draft contracts to be clear as to performance obligations and the related transaction price.

We would love to hear your in-the-field experiences with revenue recognition!