Nonprofit Income Streams: An Introduction

Over $1.85 trillion dollars of income was reported by public charities filing Form 990 or 990-EZ, based on 2016 IRS data compiled by The Urban Institute, National Center for Charitable Statistics. Where does all that money come from?

Over $1.85 trillion dollars of income was reported by public charities filing Form 990 or 990-EZ, based on 2016 IRS data compiled by The Urban Institute, National Center for Charitable Statistics. Where does all that money come from?

Specifically we are focusing on income of 501(c)(3) public charities. For comparison’s sake, here are common types of nonprofit organizations and their Internal Revenue Code (IRC) section:

- 501(c)(3) – Religious, Educational, Charitable, Scientific, Literary, Public Safety Testing, Amateur Sports Competition, and Prevention of Cruelty to Children or Animals Organizations

- 501(c)(4) – Social Welfare Organizations

- 501(c)(6) – Professional Associations, Chambers of Commerce

- 501(c)(7) – Social Clubs

As you can see, there are many types of nonprofits. IRC Section 501(c)(3) describes a special type of nonprofit that can exist for certain purposes. Before we look at the income of 501(c)(3) organizations, let’s first step back and look quickly at what makes a 501(c)(3) nonprofit so special.

What’s the big deal about 501(c)(3)?

Sometimes we’ve found that people, even board members, do not distinguish between a 501(c)(3) organization and any other kind of nonprofit entity, or even a for-profit business! Indeed it IS a big deal for an organization to qualify under Internal Revenue Code section 501(c)(3):

- Donations to 501(c)(3) organizations are tax-deductible to the donor if the donor is able to take advantage of the deduction on his or her personal tax return.

- Government entities, foundations and other funders typically require an organization to be a 501(c)(3) to be eligible for funding.

- 501(c)(3) organizations may earn both taxable and tax exempt income. It’s important to understand the difference, both for purposes of filing the appropriate tax return and paying tax and because too much taxable income can cause an organization to lose exempt status.

- Being a 501(c)(3) carries prestige and authority. People often give to a 501(c)(3) nonprofit organization regardless of personal tax benefit because they care about the mission.

If you are uncertain about an organization’s tax status, see our recent post, New IRS Tax Exempt Organization Search. Here you can easily look up an organization’s tax exempt status.

Two Types of 501(c)(3)s

501(c)(3) nonprofits may be classified as private foundations or publicly supported charities. In this post we are focused on publicly supported charities. Nonprofits operating in areas including the arts, education, the environment, health and human services, among others, are typically 501(c)(3) public charities.

Hard to Find Income Data

In this post, we want to give you an overview of where public charities derive their income. Surprisingly, though, good information on nonprofit income is hard to find. The main source of public charity statistics comes from the Form 990 and 990-EZ information returns required to be filed annually with the IRS. However these returns paint an incomplete and skewed picture. For one thing, the IRS exempts about two thirds of public charities from reporting, mostly small organizations and churches. Also Forms 990 and 990-EZ do not include the value of in-kind donations of services and rents.

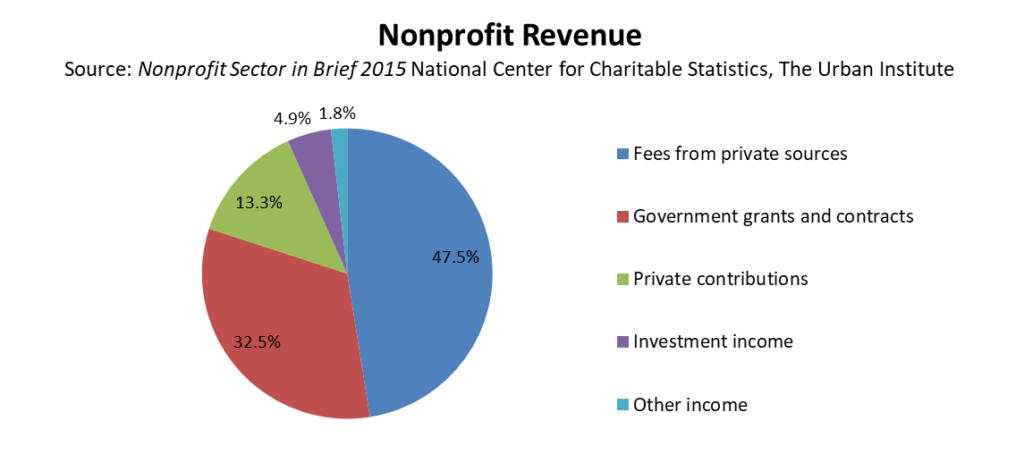

With the above limitations in mind, let’s take a look at a breakout of public charity income as compiled by The Urban Institute from 2013 Forms 990 and 990-EZ:

Nearly half of total revenue came from fees paid for goods and services by private sources. Most of these fees went to nonprofits in the hospital and higher-education sectors. If you add government contracts also considered to be “fee for service,” over 70% of nonprofit income was derived from fees charged in exchange for goods and services provided.

The next largest source of revenue came from government grants and contracts. Government revenue includes income from Medicare and Medicaid, fee-for-service contracts, and grants that are considered to be contributions. Often it is difficult to distinguish between a contract that is a grant vs. a contract that is considered fee for services.

Only 13% of income came from private contributions, including gifts made at special events, bequests, and gifts from corporations and foundations. Click here to see an infographic by Giving USA on sources of private contributions.

A Starting Point

Now you have a big picture of where public charities get their income, at least for the larger organizations required to file Form 990 or 990-EZ.

How does your nonprofit organization fund its operations? Curious to know how other organizations do it? Check out Nonprofit Explorer where you can search for nonprofits by state and type of organization. Here you can find summary financial information as well as links to filed Forms 990 or 990-EZ. You can also access filed Form 990 returns at IRS Tax Exempt Organization Search or Guidestar. (The IRS site is still being populated, so only recently filed returns are available.) To find even more information, check the nonprofit organization’s website to see if they make audited financial statements available online or ask if they can provide them.

501(c)(3) organizations are a special type of nonprofit entity that can derive income from a variety of funding sources. Dive deeper into any one of these major categories of income and you will find a myriad of detail types of income. Stay tuned for future posts as we look more closely at income sources, both tax-exempt and taxable, for small to mid size nonprofits.