No one likes audit surprises. Seems like they never go in your favor. One place you may stumble into an audit surprise is with the new revenue recognition standards. One standard applies only to nonprofits and covers contributions. The other standard applies to all entities, for-profit and nonprofit, and covers exchange transactions. We’ll explain these…

Read MoreAs a result of the coronavirus pandemic, your organization may be eligible for Federal financial assistance. Below we highlight three programs that can help nonprofit organizations. Time is of the essence. Please read and act now. 1. Paycheck Protection Program Starting this Friday, April 3, 2020, nonprofit organizations and other small businesses affected by the…

Read MoreUPDATE: Effective December 20, 2019, the “Taxpayer Certainty and Disaster Tax Relief Act of 2019” retroactively repealed the wildly unpopular tax on parking fringe benefits provided by nonprofit employers. BLOG POST BELOW IS PROVIDED FOR HISTORICAL REFERENCE ONLY Yes, starting Jan. 1, 2018, Congress is implementing a nonprofit parking tax. Hidden in the 2017 Tax…

Read MoreIn our last post we took a brief look at the nature of contributions, and all the many names that contributions go by. We distinguished contributions from exchange income. Today we look at accounts for contributions of cash. In-kind contributions, such as gifts of securities or other in-kind goods, services or rents, are for another…

Read MoreOur Nonprofit Chart of Accounts Grand Tour continues – with income accounts! As an introduction to nonprofit income, over the last few posts we explored where nonprofits get their income as reported on IRS Form 990. We also explored the concept of income diversification. Unlike balance sheet accounts, income accounts can vary widely. Reasons for…

Read MoreBefore your organization seeks to diversify income, consider three ways you may be able to move toward financial sustainability. This post continues a series on income diversification before we continue our Nonprofit Chart of Accounts Grand Tour on income accounts. 1. Reduce expenses Before you consider new sources of income, make sure you are not spending…

Read MoreIn 2014 one of our clients derived about 25% of income from one Federal pass-through grant. This grant substantially plugged the shortfall between the program service fees they charged to clients and their costs to provide the program. That year the notes to their audited financial statements cautioned (details changed): “The Organization received substantial support…

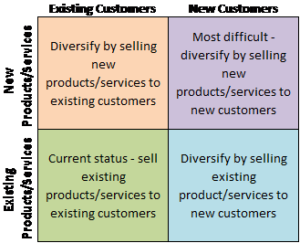

Read MoreWe’ve all heard the adage, “Don’t put all your eggs in one basket.” How does this advice hold up for nonprofit income? Before we continue our Nonprofit Chart of Accounts Grand Tour into income accounts (here’s the guide to the Tour of balance sheet accounts), first let’s consider the concept of income diversification. Income accounts…

Read MoreIn last week’s post, we saw that major sources of nonprofit income for public charities include (from largest to smallest): Fees from private sources (also called program service fees) Government grants and contracts Private contributions Investment income Other sources The above “big picture” is from Forms 990 and 990-EZ filed with the IRS. These income…

Read MoreOver $1.85 trillion dollars of income was reported by public charities filing Form 990 or 990-EZ, based on 2016 IRS data compiled by The Urban Institute, National Center for Charitable Statistics. Where does all that money come from? Specifically we are focusing on income of 501(c)(3) public charities. For comparison’s sake, here are common types…

Read More