Nonprofit Revenue Recognition Part 1 of 2

No one likes audit surprises. Seems like they never go in your favor.

No one likes audit surprises. Seems like they never go in your favor.

One place you may stumble into an audit surprise is with the new revenue recognition standards. One standard applies only to nonprofits and covers contributions. The other standard applies to all entities, for-profit and nonprofit, and covers exchange transactions. We’ll explain these terms in just a bit.

How It’s Done Now

Nonprofit organizations typically follow two patterns for entering income:

- All income is recorded as cash is received, or

- Some income is recorded as cash is received while other income is recorded as invoiced to customers and donors.

You might think invoicing is the superior method. An invoice records income and a receivable for the amount due. This is how the auditors want to see it, right?

Consider this – just because you created an invoice does not mean the revenue is properly recognized. Creating an invoice is an administrative task. You have to send an invoice if you want to get paid. Sometimes the creation of an invoice dovetails with the proper recognition of income, but it doesn’t necessarily work out that way.

In fact, sometimes recording income as cash is received is perfectly appropriate (and less accounting hassle).

Turns out there’s a whole bunch of decisions you need to make to record income properly. By “properly” we mean according to Generally Accepted Accounting Principles, the rules required for audited financial statements. According to these rules, whether or not you’ve received cash or recorded an invoice has nothing to do with whether or not you have income.

Once the auditors apply the revenue recognition rules, you might see your financial statements undergo dramatic changes.

New Revenue Standards

The new rules for revenue are laid out in two Accounting Standards Updates, known as ASUs:

- ASU 2014-09, Revenue from Contracts with Customers, (and a few subsequent clarifying ASUs) which together form Accounting Standards Codification (ASC) Topic 606 and

- ASU 2018-08, Clarifying the Scope and the Accounting Guidance for Contributions Received and Contributions Made, which resulted in ASC Topic 958-605.

By the way, you can access the Accounting Standards for free at FASB’s website.

Now if you hear your auditors talking about whether something falls under 605 or 606, you’ll know what they are referring to.

These standards became effective for audits of years beginning after 12/15/18. That means calendar year 2019 audits are affected as well as audits of years beginning in 2019.

So what are these new rules? Before we dig in, we need to define a couple of terms.

Contributions

Nonprofits receive contributions, also known as gifts, grants or donations. With a contribution, the donor does not receive anything of value (other than perhaps something of de minimis value) in return. In other words, a contribution is nonreciprocal.

Besides being nonreciprocal, contributions are also voluntary. No one is forcing a donor to make a gift.

Finally, contributions are unconditional. This means you don’t have to jump through any hoops before you can receive the money. Of course it’s common to receive conditional gifts, such as a matching grant. You just aren’t supposed to recognize the income until you’ve satisfied the condition such as raising the matching funds.

Contributions result in contribution income for the organization.

Exchange Transactions

The other term we need to define is exchange transaction. The idea behind an exchange transaction is that each party receives and sacrifices something of approximately equal value. For example you exchange dollars for an eye exam and new glasses.

A nonprofit organization may offer eye exams and prescription glasses at deeply discounted prices to people who qualify based on income. Even if the nonprofit receives less than market value, it is still considered an exchange transaction. Fees for goods and services that are part of a nonprofit’s mission are called program service fees and are exchange transactions.

Exchange transactions result in revenue for the organization.

Combo Transactions

Some transactions are a mix of contribution and exchange. Now you have to tease apart the two pieces.

The most common example we run into is with special events where someone buys a ticket. Part of the ticket price needs to be allocated to the value of the meal, entertainment or other value provided. The rest of the ticket price above and beyond the value of the event is a contribution.

A little background

In 2014 the Financial Accounting Standards Board (FASB) released ASU 2014-09 to guide how businesses and nonprofits record revenue from exchange transactions. The new standard replaced dozens of industry-specific rules with one framework for recognizing revenue from contracts.

After ASU 2014-09 came out, FASB received a lot of questions about how the recording of nonprofit income would be affected. People interpreted the rules differently and a result nonprofit income was being recorded inconsistently. (Imagine being confused over accounting rules – and these were the CPAs!)

A big question concerned government grants. Were they exchange transactions subject to the new standard? Or were they contributions subject to the guidance for gift income? Other questions had to do with distinguishing between conditional and unconditional contributions.

So FASB went back to work. The result was ASU 2018-08 which:

- Provides a better framework for determining whether a transaction should be accounted for as a contribution or as an exchange transaction, and

- Defines the criteria for determining whether a contribution is conditional (which affects the timing of when you can recognize the revenue)

The new standard also clarifies previous guidance on recording contributions.

Where are we now?

Now we get to the fun part – applying the new standards!

The timing of when income is recognized has a huge bearing on your organization’s financial statements. In an audit you might be surprised to find that

- Income you recorded because you got the cash can’t be recognized yet.

- You must record income even though you have not received any cash.

- Income recorded from an invoice you created can’t be recognized yet.

You might also find that you recorded contribution income as program service revenue or vice versa. Audited financial statements present these two types of income separately and they are subject to different recognition criteria. For management purposes, it’s nice to understand the difference as well.

If you think it all sounds like a complete, well, let’s use a polite term, confusing mess, you’re not alone. However there is a bright side. Taken together, the new standards give us a paradigm for understanding nonprofit income. And when we understand the fundamental framework, we can make better decisions for how we record income and cut down on those audit surprises.

Where to start?

First you need to determine if the award or payment that is given, promised or owed to the organization is a contribution, exchange or agency transaction.

Agency Transaction

First consider the possibility that the transaction is an agency transaction. This happens when the organization receives funds restricted by a donor for a specific beneficiary. The organization serves as a conduit through which the funds are paid to the ultimate beneficiary.

An example is an organization that collects gifts on behalf of a named individual. These are not tax-deductible contributions. Instead they are gifts to the named individual and the organization is merely serving as an agent to collect the money and give it to the recipient. The funds would be recorded to the balance sheet as a liability until paid out. They would not be recorded as contributions.

For a gift to qualify as a contribution, the organization receiving the gift must have the power to determine the beneficiary. This ability to determine the beneficiary of gift funds received is called variance power.

Contribution vs. Exchange

If you can eliminate agency transaction, then you are ready to consider contribution vs. exchange. Several criteria can help you make this determination.

Fees for Services

As we described above, fees charged for the organization’s programs result in exchange revenue. Tuition, room and board, and other program service fees for goods and services provided are exchange revenue.

A contract for specified services or other deliverables could also result in exchange revenue. For example, a nonprofit enters into a contract to help another organization with strategic planning in exchange for a fee.

Memberships

Memberships may be exchange revenue or contribution income or a combination of both.

Nonprofits commonly refer to donors, especially annual donors, as members. If benefits to donors are negligible, then such memberships are donations.

On the other hand, if the organization provides substantive benefits to members such as publications, events and educational programs, then the membership dues are not donations, they are exchange transactions.

It’s possible that membership dues are part contribution and part exchange. In that event, you need to divide the dues into the two components.

Government Grants

A government grant that benefits the general public or a charitable class is a contribution. (See our post Charitable Assistance for an explanation of “charitable class.”) For example, a government grant to provide training to disabled veterans would be a contribution.

On the other hand, payment from a government agency for services provided to specific disabled veterans would be an exchange transaction. Other examples of exchange transactions include government payments for Pell grants or Medicaid services. These benefits are always tied to specific individuals.

Government grants that benefit the general public are frequently structured as cost reimbursement grants. You recognize contribution income as you incur allowable expenses.

Ownership of the Work

A clue as to exchange vs. contribution is who retains ownership of the work or findings that result from performance of the contract. If a government agency or other funder retains ownership, it indicates an exchange transaction. For example if a university receives government funding for research and the university will retain all ownership rights to the results of the research, that indicates a contribution.

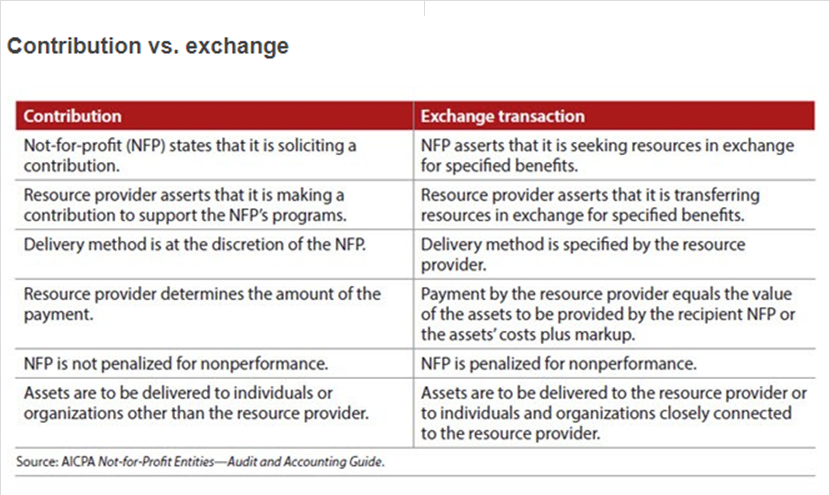

Here is a chart from the AICPA that lists attributes of contributions vs. exchange transactions:

If a donor receives name recognition as a result of a gift, as with event sponsorship, it’s still a contribution.

Next Steps for Contribution Transactions

If you determine the transaction is a contribution, here are the next steps:

Step 1 – Is the contribution conditional or unconditional?

(Note this section was updated to add more clarification on 12/9/2021.)

A condition is a donor-imposed barrier to payment combined with a right of return or a release of obligation. You cannot record contribution income until you have cleared the barrier. (Indeed you usually don’t get the money until you have satisfied the barrier.)

There are three types of barriers:

- A measurable performance-related barrier which can be…

- A specified level of service, for example a requirement for a soup kitchen to provide at least 1,000 meals per week

- A specified output or outcome, for example students must achieve a minimum test score

- A matching requirement, for example a donor promises to give $5,000 if the organization first raises $5,000 from other sources

- An outside event that needs to occur, for example the state legislature must approve the budget before grant funds are authorized

- Limited discretion as to HOW the recipient conducts activities using the gift funds.

- An example is a federal government grant that requires the recipient to adhere to Office of Management and Budget (OMB) principles.

- Federal pass-through funding awarded by state or local governments, such as CDBG reimbursement grants, also require the recipient to go by OMB principles.

- Stipulations related to the purpose of the agreement, for example

- A requirement to provide a research report that summarizes the findings from a research grant

- A requirement for an animal shelter to expand its facility to accommodate a specified number of additional animals.

Not considered a barrier to payment:

- A requirement to submit progress reports

- A purpose restriction which limits the use of a contribution to a specific activity or time, but does not dictate HOW the activity is to be performed.

Again, if a gift comes with a barrier to payment as described above and the donor also has the right to a return of the funds or a release of the obligation to pay if the barrier is not met, then it’s a conditional gift.

After you’ve satisfied any barriers to payment of a conditional gift or determined the contribution is unconditional, you can record the contribution income.

Step 2 – Is the contribution restricted or unrestricted?

Whether or not funds are restricted has huge ramifications for how you account for the grant in your bookkeeping system and how the grant is presented in your financial statements. We can’t cover all aspects of accounting for restricted gifts in this post, but we will give you some basics.

Gifts may be restricted as to time or to purpose. A time restricted gift may only be spent during a specific time period or after a point in time. Gifts and grants receivable are accounted for as time restricted because you have not received the money yet. Other grants may pay up front but restrict funds for a future period, such as a two year grant where half the grant is for year one and the rest is for year two.

A purpose restricted gift may only be spent on a specified purpose. For example an organization that provides shelter to individuals and families across several counties receives a gift restricted to providing shelter to individuals in a particular county. A purpose restriction is more narrow than the organization’s overall mission.

If you determine you have a contribution and it is restricted, then you need to manage and account for it accordingly. Here’s a link to information on our upcoming course, Accounting for Restricted Gifts and Grants in QuickBooks Online, where you can sign up to be notified when we know the course launch date. We expect this course to be released before the end of 2020.

If you are into accounting history and want more examples of how to apply ASU 2018-08, we suggest this one hour webinar from BKD CPAs called Navigating Guidance on Grants & Contributions.

In Part 2 of 2 of this post we will continue with accounting for revenue from exchange transactions.